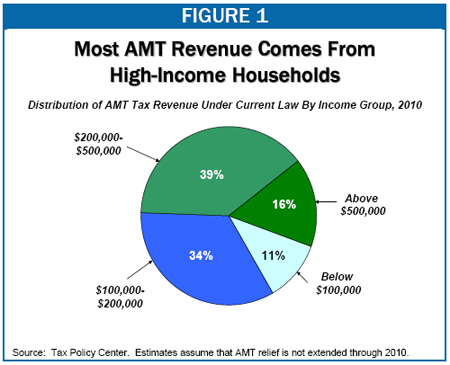

Hit Hard By The Alternative Minimum Tax (AMT)? Here Are 6 Ways To Reduce How Much You Owe | Bankrate

Alternative Minimum Tax (AMT) Credit Examples | TAN Wealth Management | Certified Financial Planner (CFP®) San Francisco | Advisor

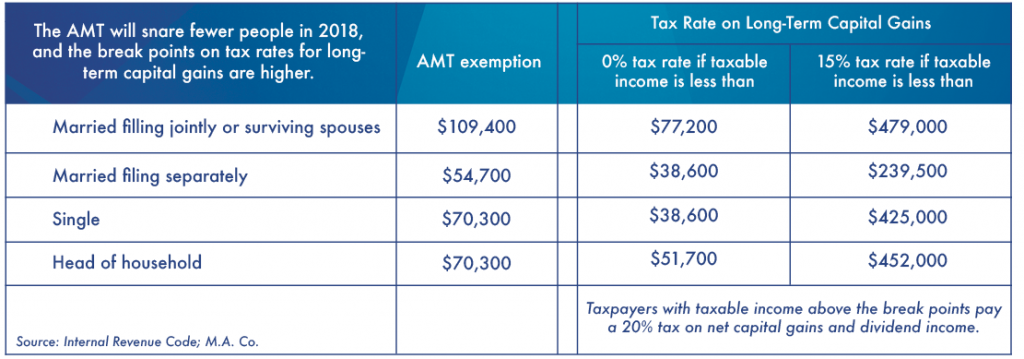

Rates Of Change: The Effect Of The American Taxpayer Relief Act Of 2012 On Individual And Fiduciary Income Taxes - Income Tax - United States

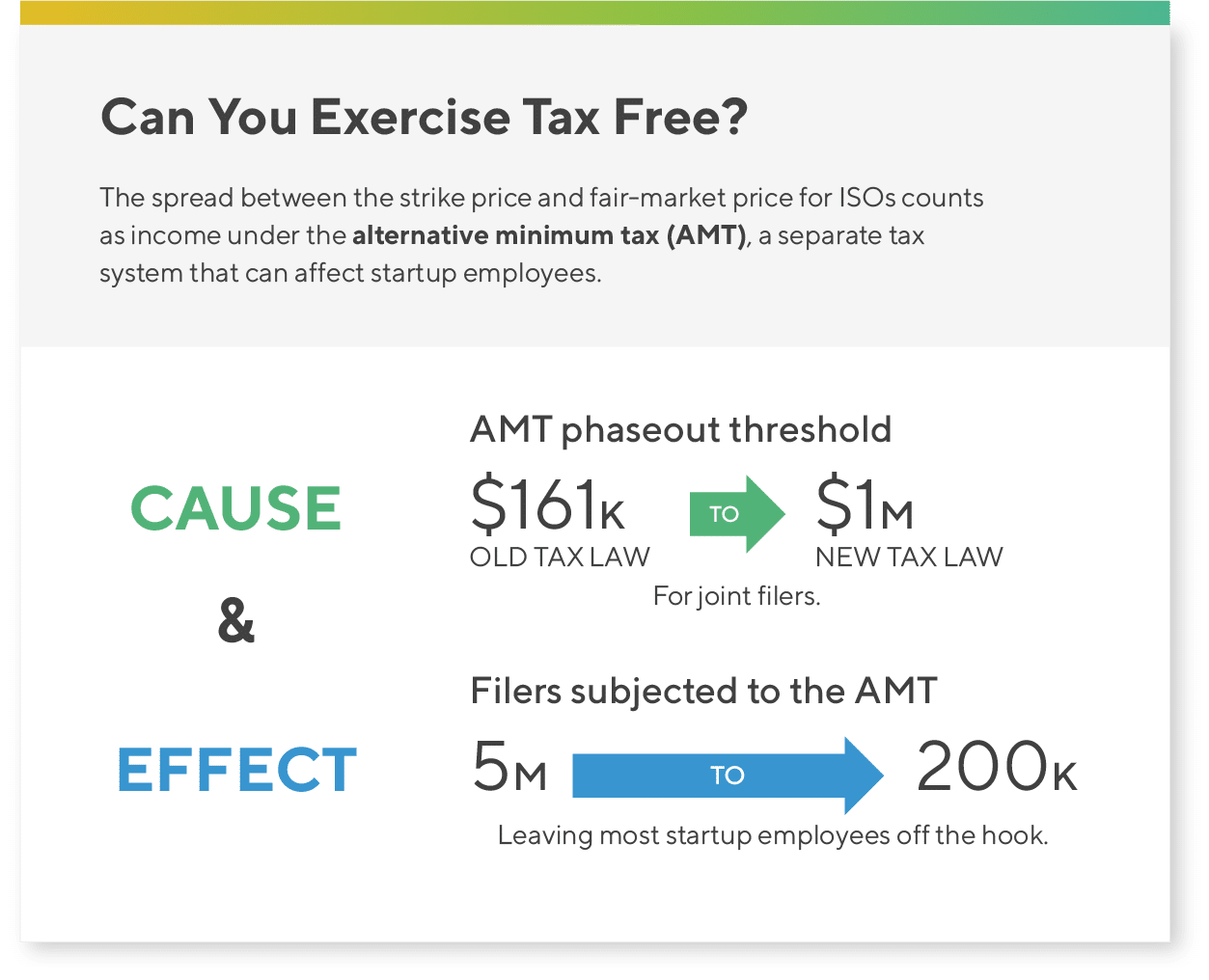

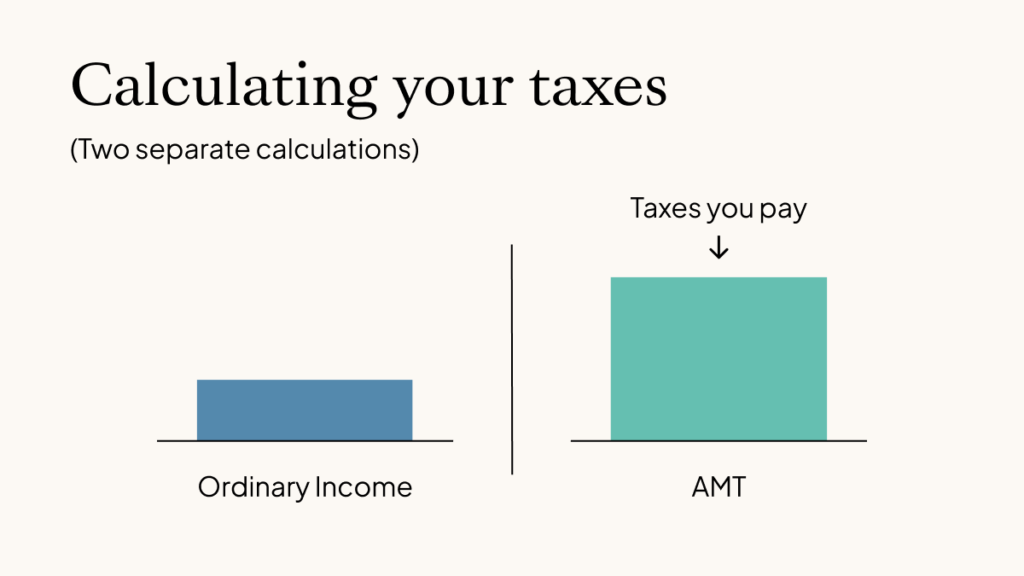

Incentive Stock Options (ISO) and their Alternate Minimum Tax (AMT) implications, and selling Stock. – dntruong's Arduino blog

Stock Options Matt Grodin CPA. 1 Definitions Incentive Stock Option (ISO)– Most tax advantaged option, but also the most complicated. You will likely. - ppt download