Spanish insurance market: Analysis of SCR, own funds and solvency ratios (2020) - Revista del servicio de estudios MAPFRE

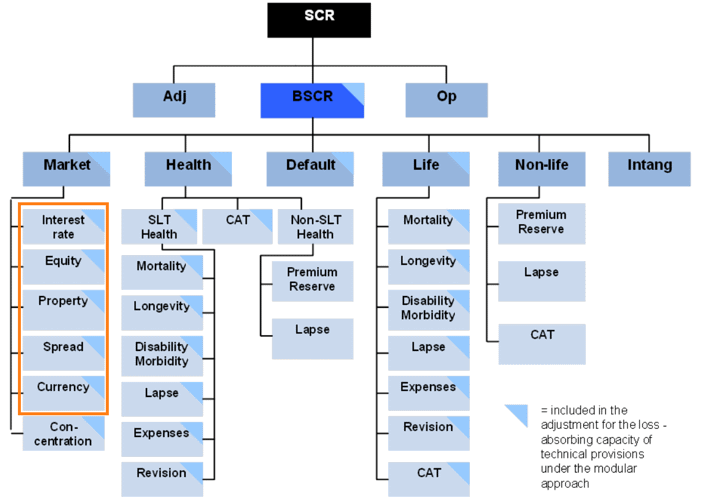

An Analysis of Solvency II Standard Formula for Calculation of SCR , possible corrections and a comparison with an internal model | Semantic Scholar

An Analysis of Solvency II Standard Formula for Calculation of SCR, possible corrections and a comparison with an internal mode

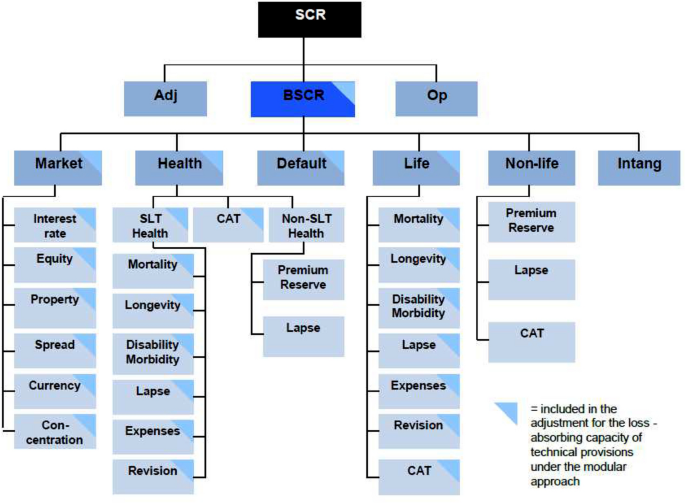

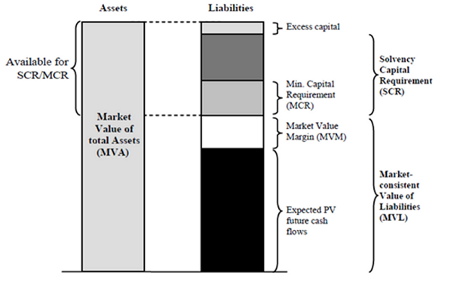

1. The overall structure of the standard formula | The underlying assumptions in the standard formula for the Solvency Capital Requirement calculation (EIOPA-14-322) | Better Regulation

CEIOPS' Advice for Level 2 Implementing Measures on Solvency II: SCR standard formula - Article 111 f Allowance of Reinsurance

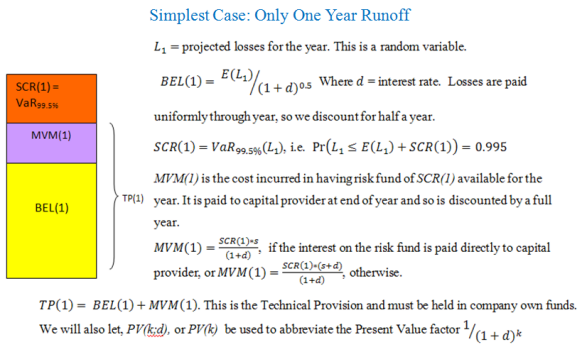

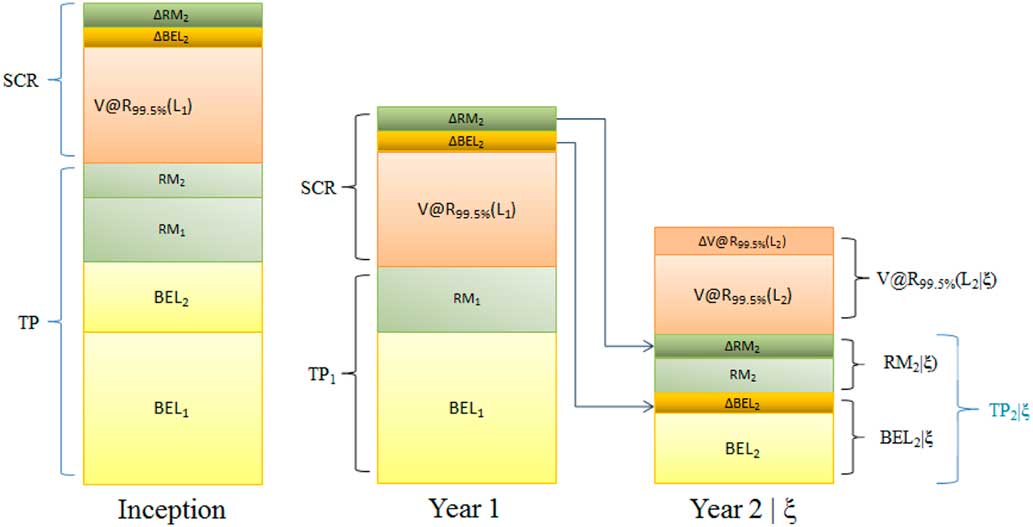

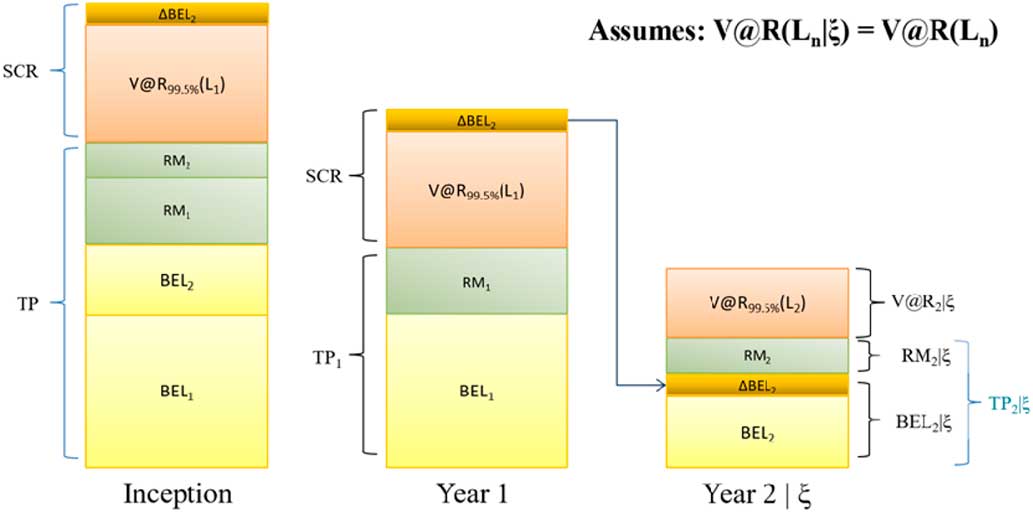

Solvency capital requirement and the claims development result | British Actuarial Journal | Cambridge Core

Solvency capital requirement and the claims development result | British Actuarial Journal | Cambridge Core